Wednesday, September 29, 2021

Friday, September 24, 2021

LegalZoom.com (LZ) began trading on the Nasdaq on Wed 30 June 21

LegalZoom.com, Inc. operates an online platform for legal and compliance solutions in the United States.

- Sector(s): Industrials

- Industry: Specialty Business Services

- Full Time Employees: 1,218

- Incorporated in 1999

- Headquartered in Glendale, California

- https://www.legalzoom.com

Wednesday, September 22, 2021

Freshworks (FRSH) began trading on the Nasdaq on Wed 22 Sep 21

Freshworks Inc. develops software solutions for businesses worldwide.

- Sector(s): Technology

- Industry: Software—Application

- Full Time Employees: 4,130

- CEO: Girish Mathrubootham (Oct 2010–)

- Founded: 2010, Chennai, India

- Headquarters: San Mateo, CA

- Founders: Girish Mathrubootham, Shan Krishnasamy

- http://www.freshworks.com

Freshworks opened at $43.50 after pricing 28.5 mln share IPO at $36/share, above the raised $32-34 expected range

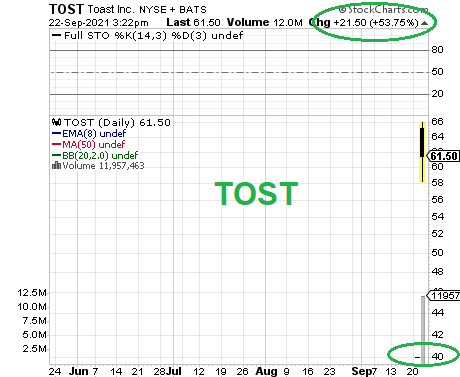

Toast (TOST) began trading on the NYSE on Wed 22 Sep 21

Toast, Inc. operates a cloud-based technology platform for the restaurant industry in the United States and Ireland. Its products are used at more than 48,000 restaurant locations.

- Sector(s): Technology

- Industry: Software—Infrastructure

- Full Time Employees: 1,900

- HQ: Boston, Massachusetts

- http://pos.toasttab.com

The IPO valued the restaurant-tech company at $20 billion

Toast opened at $65.26 after pricing 21.7 mln share IPO at $40/share, above the raised $34-36 expected range

Toast priced its IPO at $40 on Tuesday, above the expected price range of $34 to $36.

Annual recurring revenue surged 118% in the second quarter from a year earlier to $494 million as more restaurants adopted the company’s contactless payment technology.

Toast’s IPO valued the company at $20 billion, up from a valuation of $8 billion in a secondary share sale late last year.

The company raised about $870 million in its IPO, selling shares at $40 each. Toast previously said it expected to price the offering at $34 to $36, following an initial range of $30 to $33.

The stock opened at $65.26, boosting Toast’s market cap to over $32.5 billion.

Toast’s IPO comes amid a business resurgence for a company that was devastated in the early days of the pandemic, when restaurants were forced to close their doors and cities across the country shut down. In April 2020, Toast slashed half its workforce, and CEO Chris Comparato wrote in a blog post that the prior month, “as a result of necessary social distancing and government-mandated closures, restaurant sales declined by 80 percent in most cities.”

Toast CEO and co-founders

Toast was founded in 2011 by Steve Fredette, Aman Narang, and Jonathan Grimm, three veterans of Endeca, the enterprise software company sold to Oracle for $1.1 billion. Toast’s CEO is Christopher Comparato, another Endeca alum.

Founded in 2012 in Cambridge, Massachusetts, Toast started building payment technology for restaurants and eventually developed a full point-of-sale system. Prior to the Covid-19 pandemic, Toast was thriving by helping restaurants combine their payment systems with things like inventory management and multilocation controls for eateries with more than one site. Investors valued the company at $5 billion in February 2020.

Monday, September 20, 2021

IPOs this week : Sept 20 - 24, 2021 (wk 38)

- a.k.a. Brands Holdings (NYSE:AKA), Freshworks (NASDAQ:FRSH), VersaBank (OTCPK:VRRKF) and Toast (NYSE:TOST) on September 22.

- Argo Blockchain (NASDAQ:ARBK), Brilliant Earth Group (NASDAQ:BRLT), Knowlton Development (KDC), Remitly (NASDAQ:RELY), Sovos Brands (NASDAQ:SOVO) and Steling Check Corp. (NASDAQ:STER) on September 23.

- DigitalOcean (NYSE:DOCN), ACV Auctions (NASDAQ:ACVA), Diversey (NASDAQ:DSEY), Olink Holding (NASDAQ:OLK), Cricut (NASDAQ:CRCT), Vizio Holding (NYSE:VZIO), SEMrush (NYSE:SEMR), ThredUp (NASDAQ:TDUP) and Lava Therapeutics (NASDAQ:LVTX).

Wednesday, September 15, 2021

PROCEPT BioRobotics (PRCT) began trading on the Nasdaq on Wed 15 Sep 21

PROCEPT BioRobotics Corporation, a surgical robotics company, develops transformative solutions in urology. It develops, manufactures, and sells AquaBeam Robotic System, an image-guided, surgical robotic system for use in minimally-invasive urologic surgery with a focus on treating benign prostatic hyperplasia (BPH).

- Sector(s): Healthcare

- Industry: Medical Devices

- Full Time Employees: 234

- Incorporated in 2007

- Headquartered in Redwood City, California

- https://www.procept-biorobotics.com

Procept, Inc. priced upsized 6.556 mln share IPO at $25.00 per share, above the $22-24 expected range

GreenSky (GSKY) to be acquired by Goldman Sachs (GS) for $12.11/share

"Buy now pay later" fintech

- As Goldman explained it, GreenSky has a network of more than 10,000 merchants and has provided financing solutions for about 4 million borrowers. Acquiring GreenSky will help Goldman expand its presence in a key element of its consumer business.

GreenSky confirms acquisition by Goldman Sachs (GS) for $12.11/share in stock

- Goldman will acquire GreenSky in an all-stock transaction valued at approx. $2.24 billion.

- GreenSky stockholders will receive 0.03 shares of common stock of Goldman Sachs for each share of GreenSky Class A common stock. This represents a per share price for GreenSky Class A common stock of $12.11.

- The transaction is anticipated to close in Q4.

Tuesday, September 14, 2021

Sportradar Group AG (SRAD) began trading on the Nasdaq on Tue 14 Sep 21

Sportradar Group AG, together with its subsidiaries, provides sports data services for the sports betting and media industries in the United Kingdom, the United States, Malta, Switzerland, and internationally.

- Sector(s): Technology

- Industry: Software—Application

- Full Time Employees: 2,959

- Incorporated in 2001

- HQ in St. Gallen, Switzerland

- https://www.sportradar.com

Sportradar Group AG priceD 19 mln share IPO at $27.00 per share, in-line with the $25-28 expected range

Sunday, September 12, 2021

IPOs this week : Sept 13 - 17, 21 (wk 37)

- Sportradar Group (SRAD),

- Dutch Bros (BROS),

- Definitive Healthcare Corp. (DH),

- Thoughtworks Holding (TWKS),

- On Holding (ONON),

- PROCEPT BioRobotics Corp. (PRCT) and

- ForgeRock (FORG)

IPO lockup expirations

- Olo (NYSE:OLO),

- Jowell Global (NASDAQ:JWEL),

- Alzamend Neuro (NASDAQ:ALZN),

- Sun Country Airlines (NASDAQ:SNCY),

- Tuya (NYSE:TUYA),

- Vine Energy (NYSE:VEI),

- Duckhorn Portfolio (NYSE:NAPA),

- Molecular Partners (NASDAQ:MOLN),

- Gain Therapeutics (NASDAQ:GANX),

- Instil Bio (NASDAQ:TIL),

- Connect Biopharma (NASDAQ:CNTB),

- Finch Therapeutics Group (NASDAQ:FNCH) and

- AFC Gamma (NASDAQ:AFCG).

Monday, September 6, 2021

IPOs this week : Sept 6 - 10, 2021 (wk 36)

IPO lockup expirations

- First High-School Education Group (NYSE:FHS) on September 7,

- Hayward (NYSE:HAYW), Olo Inc (NYSE:OLO), Prometheus Biosciences (NASDAQ:RXDX), JOANN (NASDAQ:JOAN), Longboard Pharmaceuticals (NASDAQ:LBPH), Meatech 3D (NASDAQ:MITC) on September 8.

IPO quiet period expirations

- Eliem Therapeutics (NASDAQ:ELYM),

- Southern States Bancshares (NASDAQ:SSBK),

- Dermata Therapeutics (NASDAQ:DRMA) and

- PetVivo (NASDAQ:PETV).

Subscribe to:

Posts (Atom)