Thursday, December 22, 2022

Tuesday, December 6, 2022

Friday, December 2, 2022

FTCI : 18-month performance

ticker: FTCI

Monday, November 21, 2022

Imago BioSciences (IMGO) to be acquired by Merck (MRK) for $36.00/share

- Cos announced that the companies have entered into a definitive agreement under which Merck, through a subsidiary, will acquire Imago for $36.00 per share in cash for an approximate total equity value of $1.35 billion.

- “This acquisition of Imago augments our pipeline and strengthens our presence in the growing field of hematology,” said Merck Chief Executive Robert Davis in a news release.

- Hematology is the branch of medicine that focuses on the study of blood diseases. Imago is a clinical stage biopharmaceutical company developing new medicines for the treatment of several bone marrow diseases.

Friday, November 18, 2022

Carvana (CVNA) lays off 1,500 employees

- Carvana is laying off about 1,500 people, or 8% of its workforce, following a free fall in the company’s stock this year and concerns around its long-term trajectory.

- The email from Carvana CEO Ernie Garcia cites economic headwinds including higher financing costs and delayed car purchasing.

- He says the company “failed to accurately predict how this would all play out and the impact it would have on our business.”

- Ticker: CVNA

Carvana is laying off about 1,500 people, or 8% of its workforce, Friday following a free fall in the company’s stock this year, a weakening used vehicle market and concerns around the company’s long-term trajectory, according to an internal message first obtained by CNBC’s Scott Wapner.

The

email from Carvana CEO Ernie Garcia, titled “Today is a hard day,”

cites economic headwinds including higher financing costs and delayed

car purchasing. He says the company “failed to accurately predict how

this would all play out and the impact it would have on our business.”

Carvana

stock closed Friday at $8.06 per share, down by 3.1%. Carvana’s stock

has plummeted by about 97% this year after reaching an all-time intraday

high of $376.83 per share on Aug. 10, 2021.

Grindr (GRND) began trading on the NYSE on Fri 18 Nov 22

- Grindr begins trading on NYSE today after completing business combination with Tiga Acquisition Corp. (TINV)

Monday, November 14, 2022

Tuesday, October 25, 2022

Polestar (PSNY) began trading on the Nasdaq on Fri 24 June 22

- Polestar already has more than 55,000 vehicles on the road in China, Europe and the U.S. It has a factory up and running in China and an assembly line set to begin production later this year in a South Carolina factory shared with Volvo.

- Polestar began as a joint venture between Volvo Cars and its Chinese owner Zhejiang Geely in 2017.

- CEO Thomas Ingenlath

Friday, October 21, 2022

Amprius Technologies (AMPX) began trading on the NYSE on Thu 15 Sep 22

- Sector(s): Industrials

- Industry: Electrical Equipment & Parts

- Full Time Employees: 46

- Incorporated in 2008

- Headquartered in Fremont, California

- https://amprius.com

Friday, October 7, 2022

Saturday, September 10, 2022

Chobani withdraws plan for IPO

Thursday, September 1, 2022

Getty Images (GETY) began trading on the NYSE on Mon 25 July 22

- Sector(s): Communication Services

- Industry: Internet Content & Information

- Full Time Employees: 1,600

- Founded in 1995

- Based in Seattle, Washington.

- https://www.gettyimages.com

Wednesday, August 31, 2022

Mobile Global Esports (MGAM) began trading on the Nasdaq on Fri 29 July 22

- Sector(s): Communication Services

- Industry: Electronic Gaming & Multimedia

- Full Time Employees: 25

- Headquartered in San Clemente, CA, with an operating subsidiary in Mumbai, India

- https://www.mogoesports.com

Monday, August 15, 2022

IPOs this week : Aug 15 - 19, 2022 (wk 33)

- GigaCloud Technology (GCT) and

- Innovative Eyewear (NASDAQ:LUCY) could price their IPOs this week and start trading.

- Sunshine Biopharma (SBFM) and Vivakor (NASDAQ:VIVK) on August 15, as well as Blue

- Water Vaccines (BWV) on August 17.

Friday, July 8, 2022

Thursday, June 16, 2022

Bausch Health suspends plans for Solta IPO

Friday, May 13, 2022

SoFi Technologies (SOFI) began trading on the Nasdaq on Tue 1 June 21

- Sector(s): Financial Services

- Industry: Credit Services

- Full Time Employees: 2,500

- Founded in 2011

- HQ in San Francisco, California

- https://www.sofi.com

Wednesday, May 11, 2022

Monday, May 9, 2022

Grindr to go public in $2.1 bln SPAC deal

Saturday, May 7, 2022

Miami International Holdings confidentially files for U.S. IPO

- https://www.miaxoptions.com/

- MIAX Options, MIAX PEARL and MIAX Emerald are fully electronic options trading exchanges and wholly-owned subsidiaries of Miami International Holdings, Inc. (MIH) that comprise the MIAX Exchange Group.

- On February 21, 2019 MIAX Options launched options on the SPIKES™ Volatility Index. SPIKES™ is a measure of the expected 30-day volatility in the SPDR® S&P 500® ETF (SPY), the most actively-traded exchange traded fund in the world. SPIKES™ was developed by T3 Index (T3), a research-driven indexing firm that develops proprietary indexes as part of a partnership with MIH.

- Founded in 2017

Friday, May 6, 2022

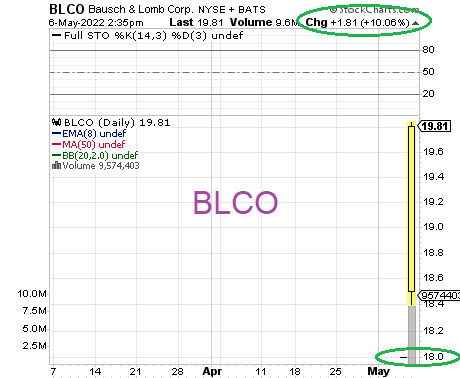

Bausch + Lomb (BLCO) began trading on the NYSE on Fri 6 May 22

Thursday, April 28, 2022

Zymeworks (ZYME) : 5-year performance

- Sector(s): Healthcare

- Industry: Biotechnology

- Full Time Employees: 455

- incorporated in 2003

- HQ: Vancouver, Canada.

- https://www.zymeworks.com

Wednesday, April 27, 2022

Postal Realty Trust (PSTL) : 3-year performance

Tuesday, April 26, 2022

Evoke Pharma (EVOK) : New FDA Market Exclusivity For Gimoti Nasal Spray

Sunday, April 17, 2022

IPOs this week : Apr 18 - 22, 2022 (wk 16)

- AN2 Therapeutics (NASDAQ:ANTX) on April 19

- Watch Stronghold Digital (SDIG),

- Context Therapeutics (CNTX),

- Portillo’s (NASDAQ:PTLO), P10 (PX), Vita Coco (COCO), Ventyx Bio (VTYX), Aris Water Solutions (ARIS), Xilio (XLO), Minerva Surgical (UTRS) and Infobird (IFBD) with insiders able to unload some shares.

Thursday, April 14, 2022

Wednesday, April 13, 2022

Tuesday, April 12, 2022

TPG Inc. (TPG) began trading on the Nasdaq on Thur 13 Jan 22

- Holding some $109 billion in assets, Texas- and San Francisco-based TPG becomes the fifth-largest publicly traded private equity firm in the U.S. by assets, again behind Blackstone ($619 billion), Apollo ($481 billion), Carlyle ($256 billion) and KKR ($252 billion).

- Founded in 1992, TPG in November announced plans to go public and owns outsize stakes in talent agency CAA, Vice Media and Spotify. Its long-awaited debut breathes new life into private equity public listings amid a massive boom in buyout deals.

Saturday, April 9, 2022

Ares Management (ARES) : 8-year performance

- May 2, 2014: Ares Management shares fell to close at $18.17, a decline of 4.4 percent from the IPO price. Ares cut the size of the offering to 11.4 million units from 18.2 million units, and the IPO priced below the estimated range of $21 to $23. The deal generated proceeds of $217 million and gave Ares a market cap of about $4 billion, or about 4.7x its 2013 net income of $850 million.

- https://www.aresmgmt.com/

Thursday, April 7, 2022

MiNK Therapeutics (INKT) began trading on the Nasdaq on Fri 15 Oct 21

- Sector(s): Healthcare

- Industry: Biotechnology

- Full Time Employees: 33

- HQ: New York, New York

- https://minktherapeutics.com