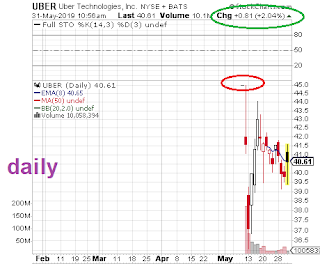

** chart 1 day before earnings **

** charts after earnings **

Uber beats by $0.03, reports revs at high end of guidance provided in IPO prospectus; does not issue guidance in press release

- Reports Q1 (Mar) loss of $2.26 per share, $0.03 better than the S&P Capital IQ Consensus of ($2.29); revenues rose 19.9% year/year to $3.1 bln, at high end of the $3.04-$3.10 bln guidance and slightly above the $3.08 bln S&P Capital IQ Consensus,

- Reports net loss of ($1.01) bln, at high end of its guidance of ($1.11)-($1.0) bln.

- Gross bookings increased 34% yr/yr to $14.65 bln.

- Monthly Active Platform Consumers (MAPCs) increased 33% yr/yr to 93.0 mln.

- Core Platform Contribution Margin decreased to (4.5)% from 17.9% yr ago.

- Co does not provide guidance in press release.

Uber: Earnings conference call notes

- Monthly Active Platform Consumers (MAPCs) increased by 33% yr/yr to 93.0 mln. But, this only represents about 2% of the total population in the geographies it currently serves.

- The growth in MAPCs was primarily driven by growth in its Uber Eats segment.

- It launched Uber Pro in 15 cities, helping drivers lower transportation costs and drive improved profitability. It plans to expand Uber Pro nationwide.

- Uber Eats jumped by 109% yr/yr as it continues to add restaurant selections at an aggressive pace. It is specifically experiencing strong up-take in suburban markets.

- Company says it expects to utilize fewer consumer promotions in Q2.

- Uber says it remains focused on developing its own in-house autonomous driving software and hardware.

- Due to improving competitive dynamics, company expects contribution margin to improve sequentially and throughout the year. Contribution margin for Q1 was (4.5)%.

- UBER does not provide specific EPS or revenue guidance during the call.