Solta is a provider in medical aesthetics with skin rejuvenation and body contouring solutions, including the Thermage® RF systems, Fraxel® laser, Clear + Brilliant® laser and VASER® ultrasonic systems.

(Reuters) - Bausch Health Companies Inc (BHC) said on Thursday it was suspending plans for the initial public offering of its unit Solta Medical due to challenging market conditions.

It has been a gloomy year for U.S. capital markets, with IPO-bound Reddit Inc and Mobileye, the self-driving car unit of Intel Corp (INTC), facing challenges.

Bausch, previously known as Valeant Pharmaceuticals, said it would revisit alternative paths for medical aesthetics company Solta in future.

In August, Bausch announced plans to pursue an IPO of Solta in a bid to shed non-core assets and cut down debt. read more

The Canadian company's debt piled up due to aggressive deal-making under former Chief Executive Officer Mike Pearson.

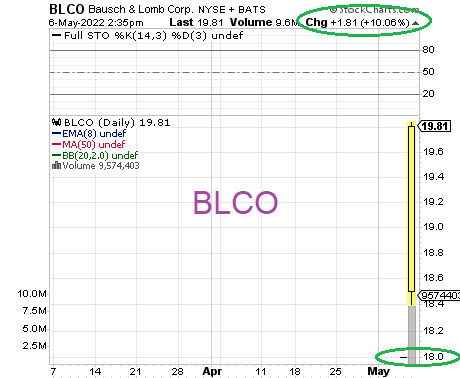

The company's eye-care unit, Bausch + Lomb (BLCO), was recently listed in the United States and Canada.