Ticker: BOJA

Friday, July 31, 2015

Thursday, July 30, 2015

Paypal (PYPL) began trading on the NASDAQ on 6 July 15

Description

PayPal Holdings, Inc. (PayPal) is a technology platform company, which enables digital and mobile payments on behalf of consumers and merchants around the world. The Company focuses on its consumers, merchants, friends and family to access and move their money through its platform using various devices, such as mobile, tablets, personal computers and wearables. It provides businesses of various sizes to accept payments from merchant Websites, mobile devices and applications, and at offline retail locations through a range of payment solutions across its Payments Platform, including PayPal, PayPal Credit, Venmo and Braintree products. PayPal gateway products include Payflow Payments and Braintree products. The Company enables its consumers to fund a purchase using a bank account, a PayPal account balance, a PayPal Credit account, a credit or debit card, or other stored value products such as coupons and gift cards.

Address

2211 N 1st St

SAN JOSE, CA 95131-2021

United States

SAN JOSE, CA 95131-2021

United States

Website

https://about.paypal-corp.com/Key stats and ratios

| Q1 (Mar '15) | 2014 | |

| Net profit margin | 11.93% | 5.22% |

| Operating margin | 15.07% | 15.80% |

| EBITD margin | - | 22.23% |

| Return on average assets | 4.60% | 2.04% |

| Return on average equity | 12.11% | 5.36% |

| Employees | 15,800 |

Monday, July 27, 2015

Planet Fitness sets terms for planned IPO to raise up to $216 mln

- Company valued at nearly $1.58 billion in its initial public offering.

- plans to sell 13.5 million shares at $14 to $16 each, or to raise up to $216 million

- J.P. Morgan, BofA Merrill Lynch, Jefferies and Credit Suisse are the lead underwriters.

Planet Fitness is selling 9.1 million shares in the offering, while selling stockholders are offering the rest.

The Newington, New Hampshire-based company, which is majority owned by buyout firm TSG Consumer Partners, has more than 950 fitness centers in the United States, most of which are franchised.

Founded in 1992, Planet Fitness has more than 7 million members. The company's cheapest package costs just $10 per month.

With its basic amenities and no-frills approach, the chain caters to first-time or occasional gym users rather than those heavily into fitness.

Planet Fitness, whose motto is "One Team, One Planet," also features on the popular TV show "The Biggest Loser."

The company aims to more than quadruple its fitness centers to over 4,000, it said in the filing.

Planet Fitness's revenue rose 33 percent to $279.8 million in 2014, while net income jumped 45 percent to $37.3 million.

Saturday, July 25, 2015

NantKwest (NK) : 51st healthcare IPO of 2015

NantKwest (NASDAQ:NK) will be the 51st initial public offering in the health care field this year if it prices Monday evening as planned. That's more than triple the next most active sectors, technology and finance, with 15 IPOs each. Health care also had the most IPOs last year, at 102.

"We've had a great extended IPO window of opportunity for these companies to get financing from the public markets," said David Miller, portfolio manager at Alpine BioVentures, which invests in public and early-stage private companies. "Companies are going from their first human trials to FDA drug approval faster than ever," he said. "Part of that is the FDA is more understanding and companies are also smarter about drug development."

NantKwest plans to raise $151 million by offering 7 million shares at a price range of 20 to 23. At the midpoint it would have a fully diluted market value of $2.2 billion. That would top a record set by biotech Juno Therapeutics (NASDAQ:JUNO), with a market valuation of $2.16 billion before its trading debut on its Dec. 19 IPO, according to Renaissance Capital, manager of the Renaissance IPO exchange traded fund.

An Industry Of M&A

There are several reasons for the surge in health care initial public offerings. Helping fan the flames are a record number of mergers and acquisitions, including some blockbuster deals.

These include the $8.4 billion that big-cap biotech Alexion Pharmaceuticals (NASDAQ:ALXN) paid to acquire Synageva BioPharma in a deal that closed last month. Synageva came public in December 2011. Another was the $3.2 billion that Teva Pharmaceutical (NYSE:TEVA) paid to acquire Auspex Pharmaceuticals, in a May pact. Auspex came public in February 2014. Another big deal was the $7.2 billion that Celgene (NASDAQ:CELG) this month announced it would pay to acquire Receptos (NASDAQ:RCPT). Receptos came public in May 2013.

Another reason is the strong flow of money coming from venture capital firms, as well as IPOs and follow-on offerings. Analysts also say that biotech companies are innovating at a pace never seen before.

"We're now in a golden age of biotechnology," said Paul Yook, portfolio manager of the BioShares Biotechnology Products Fund (NASDAQ:BBP) and Biotechnology Clinical Trials Fund (NASDAQ:BBC). "The capital is widely available and a record number of drugs are being approved."

The venture capital industry pumped $2.3 billion into biotech companies in the second quarter, according to the MoneyTree Report by the National Venture Capital Association and PricewaterhouseCoopers. That's up 32% from the prior quarter and the largest amount since the group began keeping records 10 years ago.

The largest funding round for a biotech company in Q2 was $217 million received by Denali Therapeutics. That was followed by Aduro Biotech (NASDAQ:ADRO), which received $200 million, while Adaptive Biotechnologies got $195 million. Aduro came public on April 15, raising $119 million. The stock priced at 17 and popped 147% on its first day of trading. It now trades near 27.

"There have been a lot of takeovers with tremendous premiums that are enabling some of these biotech companies with good venture capital backing and good insider buying to be the next great wonder," said Scott Sweet, senior managing partner at IPOboutique.com, a research firm.

"We've had a great extended IPO window of opportunity for these companies to get financing from the public markets," said David Miller, portfolio manager at Alpine BioVentures, which invests in public and early-stage private companies. "Companies are going from their first human trials to FDA drug approval faster than ever," he said. "Part of that is the FDA is more understanding and companies are also smarter about drug development."

NantKwest plans to raise $151 million by offering 7 million shares at a price range of 20 to 23. At the midpoint it would have a fully diluted market value of $2.2 billion. That would top a record set by biotech Juno Therapeutics (NASDAQ:JUNO), with a market valuation of $2.16 billion before its trading debut on its Dec. 19 IPO, according to Renaissance Capital, manager of the Renaissance IPO exchange traded fund.

An Industry Of M&A

There are several reasons for the surge in health care initial public offerings. Helping fan the flames are a record number of mergers and acquisitions, including some blockbuster deals.

These include the $8.4 billion that big-cap biotech Alexion Pharmaceuticals (NASDAQ:ALXN) paid to acquire Synageva BioPharma in a deal that closed last month. Synageva came public in December 2011. Another was the $3.2 billion that Teva Pharmaceutical (NYSE:TEVA) paid to acquire Auspex Pharmaceuticals, in a May pact. Auspex came public in February 2014. Another big deal was the $7.2 billion that Celgene (NASDAQ:CELG) this month announced it would pay to acquire Receptos (NASDAQ:RCPT). Receptos came public in May 2013.

Another reason is the strong flow of money coming from venture capital firms, as well as IPOs and follow-on offerings. Analysts also say that biotech companies are innovating at a pace never seen before.

Billionaire Patrick Soon-Shiong (left), NantKwest's CEO, talks health care with Michael Milken at the Milken Institute Global Conference.

"We're now in a golden age of biotechnology," said Paul Yook, portfolio manager of the BioShares Biotechnology Products Fund (NASDAQ:BBP) and Biotechnology Clinical Trials Fund (NASDAQ:BBC). "The capital is widely available and a record number of drugs are being approved."

The venture capital industry pumped $2.3 billion into biotech companies in the second quarter, according to the MoneyTree Report by the National Venture Capital Association and PricewaterhouseCoopers. That's up 32% from the prior quarter and the largest amount since the group began keeping records 10 years ago.

The largest funding round for a biotech company in Q2 was $217 million received by Denali Therapeutics. That was followed by Aduro Biotech (NASDAQ:ADRO), which received $200 million, while Adaptive Biotechnologies got $195 million. Aduro came public on April 15, raising $119 million. The stock priced at 17 and popped 147% on its first day of trading. It now trades near 27.

"There have been a lot of takeovers with tremendous premiums that are enabling some of these biotech companies with good venture capital backing and good insider buying to be the next great wonder," said Scott Sweet, senior managing partner at IPOboutique.com, a research firm.

NantKwest has several key ingredients that make it a high profile IPO. Among them is that an affiliate of drug giant Celgene is an existing stockholder. It plans to purchase $17 million in NantKwest shares in a private placement concurrent with the IPO. Another existing stockholder is mutual fund giant Franklin Templeton, which intends to buy $45 million worth of shares.

Perhaps the biggest attraction to the attention-getting IPO is billionaire Patrick Soon-Shiong, chairman and CEO, and a physician, surgeon and scientist. He plans to invest $10 million in the IPO. Soon-Shiong previously acquired a controlling stake in the company last December, when it was known as Conkwest, for $48 million.

The Soon-Shiong Connection

Soon-Shiong has a long track record of success. In 2008 he sold a generic-drug company that he controlled, American Pharmaceutical Partners, to German health care company Fresenius for $5.7 billion.

He invented and developed Abraxane, which was approved by the Food and Drug Administration to treat metastatic breast cancer in 2005, lung cancer in 2012 and pancreatic cancer in 2013. Celgene acquired the drug in its $2.9 billion buy of Abraxis BioScience in 2010.

NantKwest is also drawing attention for its area of work. It's in the hot field of immunotherapy, which deploys the patient's own immune system to fight cancer.

"We are a pioneering clinical-stage immunotherapy company focused on harnessing the power of the innate immune system by using the natural killer cell to treat cancer, infectious diseases and inflammatory diseases," NantKwest said in its IPO prospectus. Natural killer cells are also called NK cells, hence the NK stock symbol.

Juno Therapeutics was perhaps the first high-profile IPO in the immunotherapy field. It priced at 24 and raised $265 million. Juno currently trades near 52.

Another is Kite Pharma (NASDAQ:KITE), which is up 300% from its June 2014 IPO price of 17. Kite now trades near 68.

The drug development field is also full of risk. Historically for every 100 drugs that enter the oncology pipeline, just eight get FDA approval.

Wednesday, July 22, 2015

Blue Buffalo Pet Products (BUFF) began trading on the NASDAQ on 22 July 15

- Largest maker of all natural dog and cat food in the US and Canada.

- The initial public offering price is $20.00 per share. In addition, Blue Buffalo will be issuing up to 35,934 shares to approximately 1,700 non-management employees at no cost to them.

- The IPO raised $677 million.

- Blue Buffalo is the fifth largest IPO this year.

- The company says it's the fastest-growing major pet food company in the U.S., "selling dog and cat food made with whole meats, fruits and vegetables, and other high-quality, natural ingredients."

- Another pet company, PetSmart had previously traded on the Nasdaq, starting with an IPO in 1993. It was acquired in a private equity deal for $8.7 billion in December 2014.

- Blue Buffalo follows the IPO of Freshpet (NASDAQ:FRPT) in November. Freshpet, which makes and sells refrigerated food and treats for dogs and cats using natural ingredients, priced its IPO shares at 15. The stock ticked up 0.2% to 18.46 Wednesday, up 23% from its IPO price.

- Blue Buffalo estimates the U.S. pet food industry had $26 billion in retail sales in 2014, with 63% of households purchasing pet food. Globally, sales hit $75 billion, according to Euromonitor.

- The largest provider of pet food is Nestle Purina, with an estimated 33% U.S. market share. Blue Buffalo says it has a 6% share, feeding 2% to 3% of the 164 million pets in the U.S.

- The Wilton, Conn.-based company was founded in 2002 by Bill Bishop and his two sons. Their inspiration for starting the company came as a result of their dog Blue coming down with cancer at a young age. Concerned about the lack of healthy ingredients in pet food, the Bishops decided to "develop a pet food that would provide a diet of high-quality, natural ingredients."

Address

11 River Rd Ste 103

WILTON, CT 06897-6011

United States

WILTON, CT 06897-6011

United States

Friday, July 17, 2015

Rapid7 (RPD) began trading on the NASDAQ on 17 July 15

- Boston-based cybersecurity firm

Description

Rapid7, Inc. is a provider of security data and analytics solutions.The Company offers three solution groups: threat exposure management, which includes its Nexpose, Metasploit and AppSpider products; incident detection and response, which include its UserInsight product and its incident response services, and security advisory services. Its threat exposure management solutions reflect its evolution and enhancement of management tools to encompass a set of data, including real-world threat information, and analytics that facilitate systematic remediation. Its incident detection and response solutions offer customers a combination of product-based analytics, as well as services to help detect attackers and respond to attacks once they are discovered. Its security advisory services help organizations implement and manage an analytics-driven security approach by looking at their security programs and providing them with advice related to prevention, detection and correction.

Labels:

2015 IPOs,

cybersecurity IPOs,

first day of trading,

NASDAQ,

RPD,

tech IPOs

Thursday, July 16, 2015

Ollie's Bargain Outlet Holdings (OLLI) began trading on the NASDAQ on Thur 16 July 15

Ollie's Bargain Outlet Holdings operates 388 stores in 25 states in the eastern half of the United States. The company was formerly known as Bargain Holdings, Inc. and changed its name to Ollie's Bargain Outlet Holdings, Inc. in March 2015.

- Sector(s): Consumer Defensive

- Industry: Discount Stores

- Full Time Employees: 4,400

- Founded in 1982

- Headquartered in Harrisburg, Pennsylvania

- http://www.ollies.us

Priced its 8.9 million shares $16 per share

Wednesday, July 15, 2015

Sunday, July 12, 2015

Saturday, July 11, 2015

Groupon (GRPN) : 3-year performance

Friday, July 10, 2015

Wednesday, July 8, 2015

Albertsons filed for an IPO

Boise, Idaho-based Albertsons did not say how many shares it would offer, what they would cost or where those shares would trade. It said it expects to raise $100 million from the offering, though that figure is only an estimate used to calculate a filing fee. Proceeds from the offering will be used to repay debt and for general expenses.

Albertsons closed its $8 billion buyout of Safeway in January, drastically increasing the company's size. It now operates 2,205 stores in 33 states under 18 names. Safeway locations make up 1,247 of those stores. Other names under Safeway operations include Vons, Tom Thumb and Randalls.

The company also operates 456 Albertsons supermarkets in 16 states. Other retail banners include Shaw's, Acme, United Supermarkets, Pavilions, and Star Markets.

Albertsons employs about 265,000 full- and part-time workers. It had revenue of $27.2 billion in fiscal 2014, but the addition of Safeway results boosts that revenue figure to $57.5 billion, which makes it the second-largest traditional supermarket chain the U.S. behind Kroger.

*****

Thursday, July 2, 2015

Wednesday, July 1, 2015

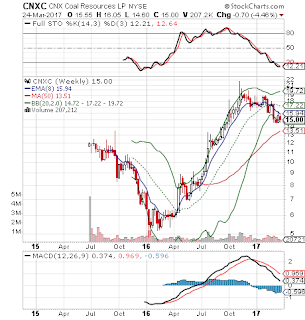

CNX Coal Resources (CNXC) began trading on the NYSE on 1 July 2015

- CNX Coal Resources (CNXC) raised $75 million by offering 5 million shares at its expected price of 15, and was up more than 1%.

- The company is a master limited partnership recently formed by Consol Energy (CNX) to manage and develop thermal coal operations in Pennsylvania.

- Div/yield 0.51/13.67

- Charts 25 March 2017 (1 year 9 months after IPO)

Labels:

2015 IPOs,

CNX Coal Resources (CNXC),

energy IPOs,

MLP IPOs,

NYSE

ConforMIS (CFMS) began trading on Nasdaq on 1 July 2015

- ConforMIS, which makes customized knee replacement implants, sold nine million shares at a price of $15 each. The stock rose to $19.25 by the end of trading Wednesday, giving the company a market value of about $750 million.

- The company, founded in 2004 in Redwood City, Calif., moved to Massachusetts in 2008. It reported $48 million in sales and a loss of nearly $46 million last year.

- Joint bookrunners for the offering are JPMorgan and Deutsche Bank. Co-managers are Wells Fargo Securities, Canaccord Genuity and Oppenheimer. The underwriters have a 30-day option to purchase an additional 1.35 million shares.

- charts 24 March 2017 (1 year 9 months after IPO)

Teladoc (TDOC) began trading on the NYSE on 24 March 2015

- Teladoc raised $158 million, offering 8.3 million shares at 19, above its expected range of 15 to 17.

- Headquarters: Purchase, NY; Founded: 2002

- Teladoc is the first and largest telehealth provider in the nation. It estimates that the public’s frustration with emergency room visits, physician shortages and long waits for appointments will serve as a platform for long-term growth.

- JPMorgan and Deutsche Bank Securities were Teladoc’s joint book-running managers for the offering. William Blair, Wells Fargo Securities and SunTrust Robinson Humphrey were the co-managers.

Teladoc says it completed about 300,000 telehealth visits in 2014, including patient diagnosis, treatment recommendations and medicinal prescriptions.

Teladoc says it had 8.1 million members in 2014, up 31% from 2013. It reported revenue of $43.5 million in 2014, up 122%, and a net loss of $17 million.

"We are very pleased with the investors' positive reaction to the Teladoc story, our market leadership and the opportunity to revolutionize the health care system," company CEO Jason Gorevic said in a statement via email.

Address

2 Manhattanville Rd Ste 203

PURCHASE, NY 10577-2118

United States

PURCHASE, NY 10577-2118

United States

Key stats and ratios

| Q4 (Dec '16) | 2016 | |

| Net profit margin | -38.13% | -60.26% |

| Operating margin | -35.37% | -57.75% |

| EBITD margin | - | -38.49% |

| Return on average assets | -18.54% | -27.83% |

| Return on average equity | -24.18% | -36.25% |

| Employees | 670 |

Subscribe to:

Posts (Atom)