Shares of DavidsTea Inc, a specialty tea retailer that has grown rapidly in Canada and the United States since its founding in Montreal in 2008, rose as much as 39 per cent in their U.S. debut, valuing the company at about US$600 million.

The company’s IPO raised about US$97 million after the stock was priced at US$19 per share, above the top end of the expected price range of US$17-US$18.

The stock hit a high of US$26.30 in early trading on the Nasdaq on Friday.

DavidsTea is the second Canadian company to list on the U.S. exchange this year. E-commerce software maker Shopify Inc listed its shares on the New York Stock Exchange and the Toronto Stock Exchange last month.

DavidsTea, which sells more than 150 types of tea through 161 stores in Canada and the United States and its

davidstea.com website, sold 2.9 million of the 5.1 million shares offered.

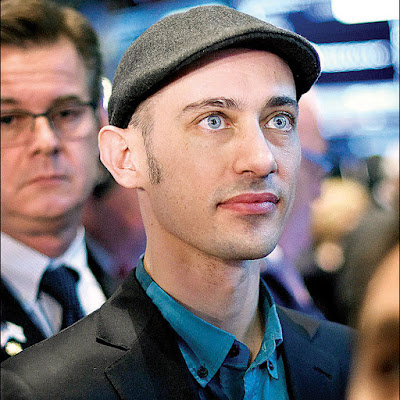

Co-founders David and Herschel Segal, along with venture capital firm Highland Consumer Partners, sold the rest.

David Segal raised about US$14.2 million from the offering while his cousin Herschel raised about US$5.1 million.

Herschel Segal, who also founded the Le Chateau Inc clothing chain, retains a 53.4 per cent stake in DavidsTea through his Rainy Day Investments Ltd.

Highland Consumer Partners has 14.7 per cent, while David Segal holds 6.6 per cent.

DavidsTea’s most popular brews – which can be bought packaged or sipped in the store – include Buddha’s Blend, an infusion of jasmine pearls, hibiscus blossoms and green tea.

Most of its teas sell for US$7.00-US$9.50 for a 50g pack, but Japanese gyokuro loose leaf teas sell for as much as US$19.50.

DavidsTea, whose main competitor is Starbucks Corp’s Teavana, has doubled its store count in four years. The company operated 130 stores in Canada and 24 in the United States as of Jan. 31. It expects to open about 25-30 stores in Canada and 10-15 stores in the United States in 2015.

DavidsTea reported a 31 per cent rise in revenue to US$141.9 million for the year ended Jan. 31. Net income was US$6.4 million, compared with a loss of US$6.2 million a year earlier.