- Shopify provides a cloud-based e-commerce platform designed for small- and medium-size businesses. Merchants use its software to run their business across all of their sales channels, including web, tablet and mobile storefronts, social media storefronts, and brick-and-mortar retailers.

- Its competitors include Amazon (NASDAQ:AMZN), Oracle (NYSE:ORCL) and eBay (NASDAQ:EBAY).

- In the first quarter, Shopify reported revenue of $37.3 million, up 98%, and a net loss of $4.5 million.

- The lead underwriters are Morgan Stanley and Credit Suisse. Shopify will list on the NYSE under the ticker SHOP, set to begin trading Thursday.

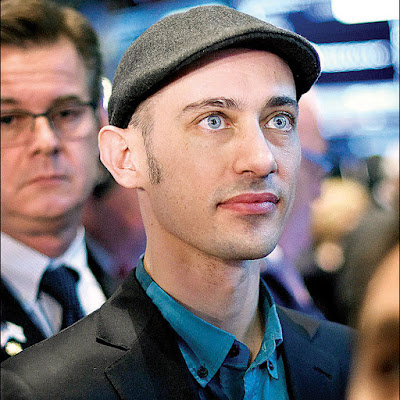

Shopify founder and CEO Tobi Lutke

Shopify increased the price of its IPO, indicating strong demand for shares of the provider of e-commerce services for small to medium-sized businesses.

Shopify raised its offering price to a range of 14 to 16 a share, from 12 to 14. At the midpoint, Shopify would raise nearly $116 million by selling 7.7 million shares and have a valuation above $1 billion.

The initial public offering is set to price late Wednesday and begin trading Thursday on the NYSE under the ticker SHOP.

The Ottawa, Canada-based company provides a cloud-based platform that businesses use to manage their stores across multiple sales channels, including Web, mobile, social media and brick-and-mortar locations.

Shopify says it powers over 165,000 businesses worldwide. Its customers include Tesla Motors (NASDAQ:TSLA), Budweiser, Google (NASDAQ:GOOGL) and Wikipedia.

Its competitors include Amazon.com (NASDAQ:AMZN) and Oracle (NYSE:ORCL).

In Q1, Shopify reported revenue of $37.3 million, up 98% from the year-earlier quarter, and a net loss of $4.5 million.

Shopify is one of five IPOs this week expected to raise about $1 billion in proceeds. These include e-commerce technology provider Baozun, which plans to raise $143 million by offering 11 million shares at a price range of 12 to 14 per share.

China-based Baozun provides e-commerce services designed to help its brand partners establish a market presence and launch products on official brand stores and major online marketplaces. With the offering, Alibaba Group (NYSE:BABA) will have an 18.2% stake in Baozun. It will list on the Nasdaq under the ticker BZUN and is set to begin trading Thursday.

No comments:

Post a Comment