Energizer Holdings is an American manufacturer of batteries

- Headquarters: St. Louis, MO

- Founded: 1896

- energizerholdings.com

- Div/yield 0.28/2.63

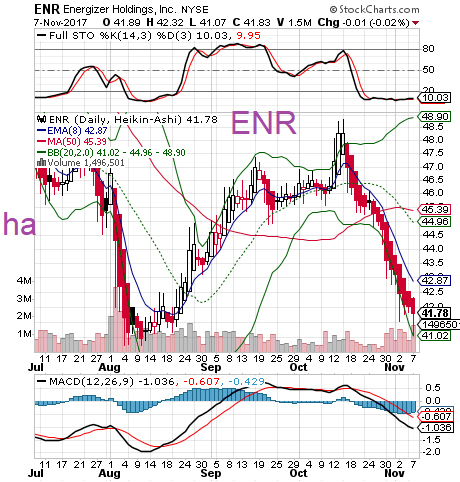

** charts before earnings **

** charts after earnings **

Energizer beats by $0.05, beats on revs; guides FY18 EPS in-line; plans to raises dividend 5% next quarter

- Reports Q4 (Sep) earnings of $0.54 per share, $0.05 better than the Capital IQ Consensus of $0.49; revenues rose 7.5% year/year to $465 mln vs the $437.36 mln Capital IQ Consensus. Organic net sales increased 7.5%, due primarily to hurricane activity in the U.S., distribution gains in certain international markets and timing of holiday activity and the favorable impact of pricing initiatives. These items were partially offset by additional investments made during the quarter related to our portfolio optimization. Favorable movement in foreign currencies resulted in increased sales of $0.1 million, or 0.1%.

- Co issues in-line guidance for FY18, sees EPS of $3.00-3.10 vs. $3.04 Capital IQ Consensus Estimate. Net Sales on a reported basis are expected to be up low single digits: Organic net sales are expected to be up low single digits, including lapping the impact of hurricane activity of ~$26 million and lapping distribution in fiscal 2017; Favorable movements in foreign currency are expected to benefit net sales by 1.0% to 1.5% based on current rates. Gross margin rates are expected to be essentially flat with the current year, excluding fiscal 2017 acquisition and integration costs, as improved pricing is offset by increased commodity costs and the repositioning of lithium pricing.

- Dividends are expected to increase 5% beginning in the first quarter of fiscal 2018, subject to Board approval.

No comments:

Post a Comment